ESG Investing in the UAE: What Global Investors Expect from Developers

Ethical capital is no longer an outlier; it’s the expectation. ESG investing, which prioritises environmental, social and governance factors, is reshaping how global investors assess real estate opportunities in the United Arab Emirates.

Gone are the days of purely financial metrics. Today’s capital flows towards projects that uphold transparency, community value and environmental resilience. As the UAE doubles down on its sustainability ambitions, international stakeholders are watching and investing accordingly.

What Sets ESG Investing Apart?Unlike traditional investing, ESG investing takes into account how companies manage their environmental footprint, social responsibility, and governance frameworks. These non-financial indicators help measure long-term resilience, reputational strength and ethical alignment.

Since 2020, companies listed in the UAE have been required by the Securities and Commodities Authority (SCA) to report on ESG performance annually (HSBC). This regulatory shift brings investor attention to sustainability metrics, which were once considered optional.

ESG, Sustainable, and Socially Responsible Investing: What’s the Difference?It’s easy to confuse ESG with its ethical investing, but each has distinct nuances:

-

ESG investing focuses on evaluating companies using environmental, social, and governance metrics.

-

Socially Responsible investing (SRI) filters out companies that harm society or the environment.

-

Sustainable investing supports initiatives that actively benefit the planet or communities.

In a region known for rapid development, the UAE is building its next economic chapter on a foundation of sustainability. ESG investing supports this vision by directing capital into projects that reduce emissions, foster social equity and uphold corporate ethics.

This alignment with global investor values reduces reputational risks, supports regulatory compliance and enhances long-term resilience. It also positions UAE developers as serious contenders on the global real estate stage.

What ESG Factors are Global Investors Prioritising?Global investors assess ESG readiness using practical and measurable indicators:

-

Environmental: Energy efficiency, carbon emissions, water and waste management.

-

Social: Fair labour practices, community engagement, and inclusive hiring.

-

Governance: Board diversity, transparent reporting, and ethical leadership.

Recent surveys show 84 per cent of UAE retail investors consider ESG when making investment decisions (The National News). That’s not a trend, it’s a direction.

ESG Investment Strategies in Real EstateSmart capital follows structure. In the UAE’s real estate landscape, common ESG strategies include:

-

Pursuing green building certifications (e.g. LEED, Estidama, Dubai Green Building Regulations)

-

Improving ESG reporting practices using global frameworks like GRI or SASB

-

Offering transparency on emissions, labour, and governance performance

-

Aligning with national sustainability agendas such as the Net Zero 2050 commitment

These efforts make a clear case for long-term value and trust.

What Global Investors Expect from UAE Developers?It’s not just about glossy green façades anymore. Investors are looking under the hood:

-

Do developers disclose ESG metrics publicly?

-

Are green construction practices embedded in operations?

-

Is there a clear link between sustainability claims and action?

Developments backed by ethical leadership, local outreach, and consistent ESG reporting attract higher-value partnerships. Transparency builds credibility and unlocks global capital.

From Policy to Practice: ESG Compliance in ActionSince the SCA mandate in 2020, UAE developers have been required to submit annual sustainability reports. These outline plans for:

-

Emissions tracking

-

Social development programmes

-

Governance performance

The aim? Give investors the clarity they need to assess risk and opportunity.

Building Green: Certifications That MatterGreen buildings aren't just good for the environment, they're good business. Certified projects often command higher rents and sales premiums. Standards like LEED, Estidama, and Dubai’s own Green Building Regulations have become vital benchmarks.

These certifications set clear criteria for:

-

Energy and water efficiency

-

Low-impact design and construction

-

Healthier living spaces

They also directly support the UAE’s broader climate ambitions.

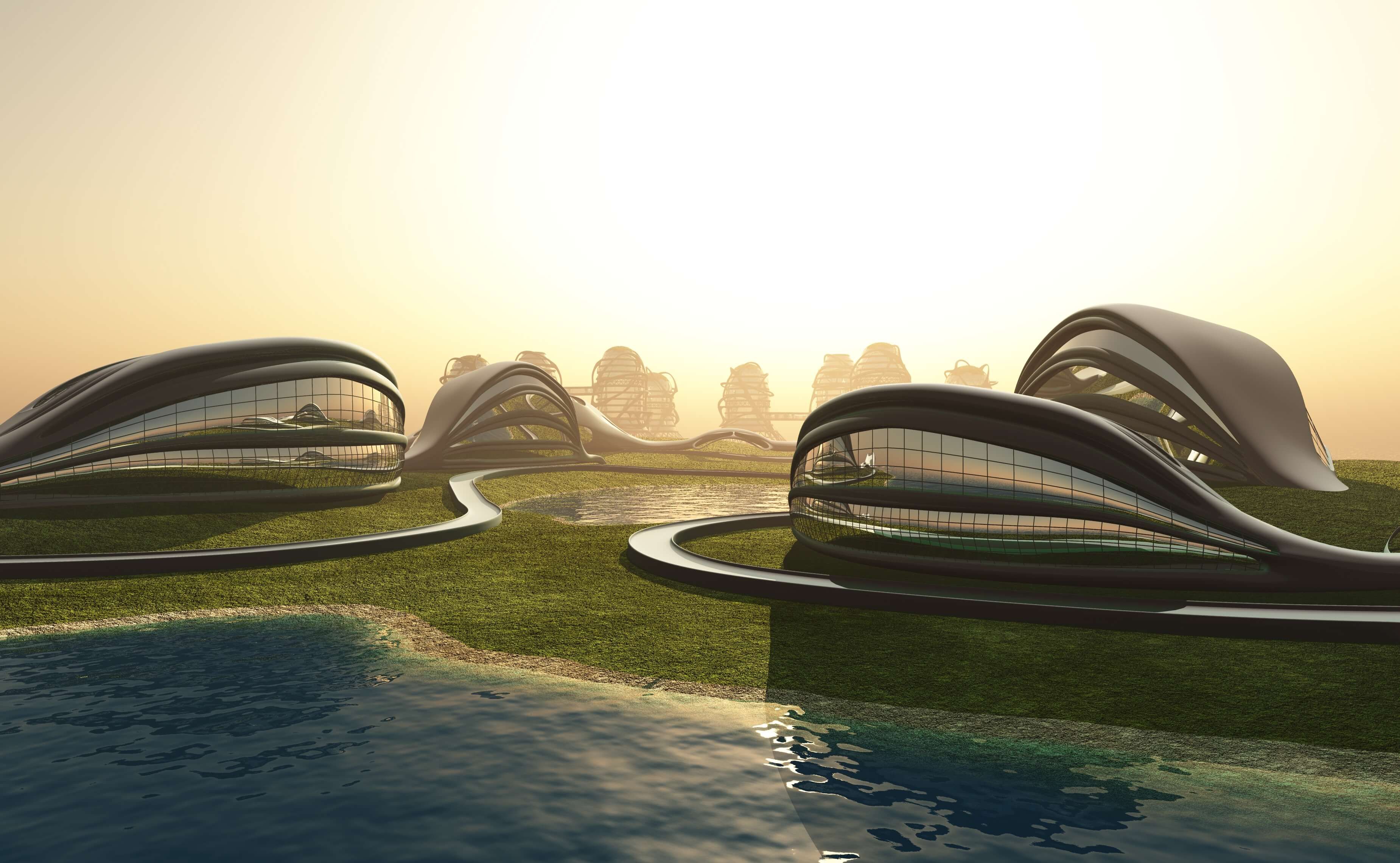

Innovation and Impact: A New Standard for Real EstateIt’s estimated that 80 per cent of UAE residents and 70 per cent of foreign buyers would pay more for sustainable buildings (Firstbit). This is where innovation becomes opportunity:

-

Renewable energy systems

-

Smart waste management

-

Air-quality improvements

In this context, innovation isn’t about flair; it’s about fulfilling real ESG goals.

Governance and Social Impact: Building TrustTransparent board structures, fair compensation and responsible management are non-negotiables for serious investors. The Dubai Clean Energy Strategy 2050 is one of several initiatives that hold developers accountable to national sustainability and governance priorities (Finanshels).

Strong governance paired with community engagement, including charitable efforts, workforce diversity and local partnerships, elevates investor trust.

How Developers Can Align with ESG ExpectationsTo meet global ESG expectations, UAE developers can:

-

Set quantifiable ESG goals

-

Use verified reporting frameworks (e.g. GRI, SASB)

-

Participate in green finance mechanisms (e.g. sustainability-linked loans)

-

Hire diverse teams and adopt circular design principles

But consistency is key. Greenwashing, overstating ESG efforts without proof, can backfire and damage reputations.

Final WordThe rise of ESG investing is reshaping real estate in the UAE. What was once optional is now essential. Investors want transparency, sustainability, and ethics baked into every square metre.

Developers who step up, those who measure, report, and innovate, don’t just meet demand; they shape the future of the market.

FAQsQuestion: What ESG factors do investors consider in UAE real estate?

Answer: Carbon output, water and energy usage, labour practices, and board transparency are top criteria.

Question: How does ESG differ from socially responsible or sustainable investing?

Answer: SRI excludes harmful sectors, and sustainable investing targets a positive impact. ESG considers all factors, including governance, to provide a well-rounded view.

Question: What risks do developers face in adopting ESG?

Answer: Higher initial costs, regulatory complexity, and the risk of greenwashing if claims aren’t backed by action.

Question: How does ESG support long-term real estate value?

Answer: It boosts reputation, reduces compliance risk, and secures investor confidence, all of which support asset stability.

)

)

)