Essential Risk Management Strategies in Real Estate Investors in the UAE

Most property investors in the UAE approach risk management like they're ticking boxes on a compliance form. That methodical approach might keep regulators happy, but it won't protect your capital when the market shifts. Real risk management strategies in real estate demand something more nuanced - understanding not just what could go wrong, but precisely how each risk compounds the others.

Key Risks in Real Estate Investing

Financial Risk

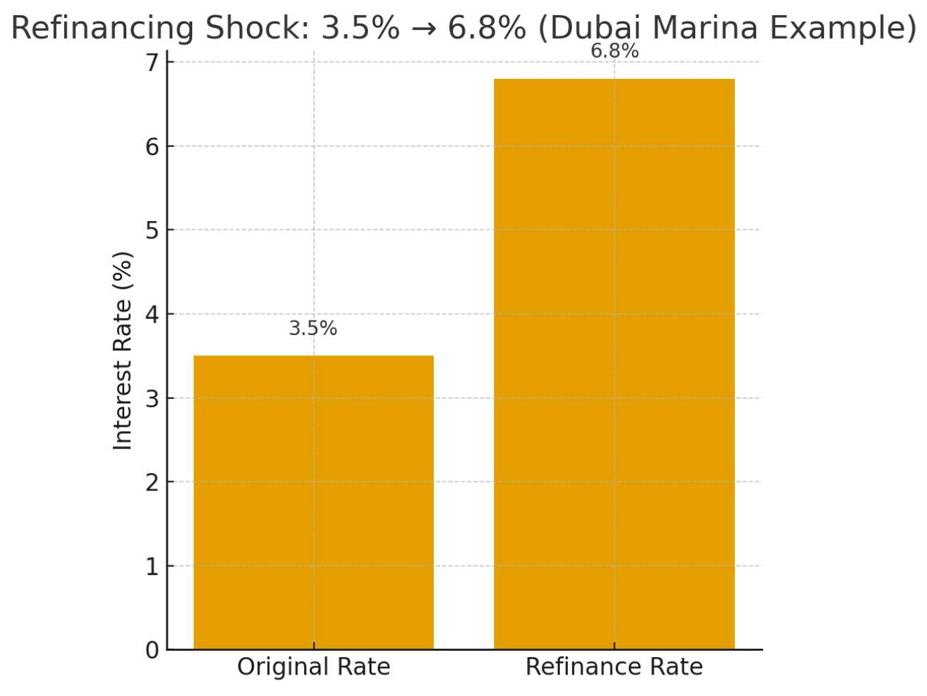

Financial risk hits hardest when interest rates spike or lending criteria tighten overnight. Picture this: a developer in Dubai Marina who secured financing at 3.5% suddenly faces refinancing at 6.8%. That's not a minor adjustment. It's the difference between healthy returns and haemorrhaging cash. The UAE Central Bank's recent mortgage cap adjustments have already caught several investors off guard, particularly those leveraged beyond 75% LTV (loan-to-value ratio).

Liquidity RiskHere's what keeps smart investors awake at 2 AM: knowing their AED 5 million property is worth exactly zero if they need cash tomorrow. Liquidity risk in UAE real estate isn't theoretical - it's brutally practical. Properties in emerging areas like Dubai South might appreciate beautifully over five years, but try selling one in 30 days when you need capital for another opportunity. You'll take a 15-20% haircut. Minimum.

Market RiskMarket cycles in the UAE move faster than most investors realise. The 2014-2016 correction saw values drop 15% while everyone was still talking about the boom. Today's challenge? Oversupply in certain segments while undersupply drives prices skyward in others. Does your portfolio account for this schizophrenic behaviour?

Legal RiskThe legal landscape shifts constantly here. New ownership laws, changing visa regulations, and evolving tax structures create a minefield of compliance issues. One overlooked RERA regulation or missed AML filing deadline can freeze your entire transaction. Legal risk isn't about big court battles - it's about the hundred small compliance points that can derail your investment.

Environmental RiskEnvironmental considerations extend beyond the obvious flooding concerns in coastal developments. The real risk? Energy efficiency mandates that could make your property obsolete. Buildings without proper insulation or modern cooling systems face massive retrofit costs or rental income penalties as tenants demand greener spaces.

Property Management RiskBad property management destroys value faster than market downturns. Service charge disputes, maintenance backlogs and tenant conflicts compound into serious financial drains. The difference between a professionally managed building in Business Bay and a poorly run one? About 30% in rental yield and 20% in capital appreciation over three years.

Replacement Cost RiskConstruction costs in the UAE have surged 23% since 2021. If your insurance coverage hasn't kept pace, you're essentially self-insuring the gap. Replacement cost risk becomes critical when materials shortages and labour costs spike simultaneously - exactly what's happening now.

Top Risk Management Strategies for UAE Real Estate Investors

Enhanced Due Diligence and AML Compliance

Forget basic title checks. Enhanced real estate due diligence means forensic-level investigation into ownership chains and funding sources and potential red flags. The UAE's greylisting episode taught everyone a harsh lesson about AML compliance. Now, successful investors maintain complete transaction trails, verify beneficial ownership through multiple databases, and document every dirham's journey. It's tedious work. But it beats having your assets frozen.

"The cost of proper due diligence is always less than the cost of getting it wrong" - this principle has saved countless investors from catastrophic losses in the UAE market.

Portfolio Diversification Across Property Types

Diversification isn't just owning properties in different emirates. Smart diversification means balancing:

- Residential units for stable rental income

- Commercial spaces for higher yields

- Industrial properties for long-term appreciation

- Mixed-use developments for flexibility

The magic happens when these different asset types move on different cycles, smoothing your overall returns.

Technology-Driven Risk Assessment Tools

Manual spreadsheets for property risk assessment are dead. Modern investors use AI-powered platforms that analyse thousands of data points - from foot traffic patterns to social media sentiment about neighbourhoods. These tools spot emerging risks months before they show up in traditional metrics. PropTech solutions now predict maintenance issues before they occur and flag regulatory changes while they're still in draft form.

Market Risk Mitigation Techniques

The sharpest investors hedge market risk through strategic timing and structured deals. Options contracts on off-plan properties let you control upside while limiting downside. Joint ventures spread risk across multiple parties. But here's the real secret: exit planning before entry. Know exactly how you'll liquidate each asset before you buy it.

Liquidity Risk Management Approaches

Managing liquidity means more than keeping cash reserves. Structure your portfolio with:

| Asset Type |

Liquidity Timeline |

Portfolio Allocation |

|

Prime Location Studios |

30-60 days |

20% |

|

Mid-Market 1-2 BR |

60-90 days |

40% |

|

Luxury Properties |

90-180 days |

25% |

|

Development Land |

180+ days |

15% |

This staggered approach ensures you're never forced to accept desperation pricing.

Critical Risk Assessment Methods in UAE Property Investment

Value at Risk (VaR) Analysis

VaR tells you the maximum loss you might face under normal market conditions. For UAE real estate, calculate your 95% VaR over a 12-month horizon. If that number makes you uncomfortable, your portfolio is too aggressive. Most institutional investors target a VaR below 15% of portfolio value. Individual investors often discover their actual risk tolerance is half what they imagined.

Sensitivity Analysis for Key Variables

Test your portfolio against multiple scenarios simultaneously. What happens if occupancy drops 20% AND interest rates rise 2% AND the dirham weakens? Sensitivity analysis reveals which variables actually matter. Spoiler: rental income sensitivity usually trumps capital appreciation concerns for most portfolios.

Geographic Information Systems for Location Risk

GIS technology transforms location analysis from guesswork to science. These systems overlay crime statistics, infrastructure developments, demographic shifts and environmental hazards onto detailed maps. The result? Precise understanding of location-specific risks down to individual building plots. That new metro station might boost values - or it might bring noise and congestion that drives tenants away.

Real-Time Compliance Monitoring Systems

Regulatory compliance in the UAE changes faster than most investors can track manually. Real-time monitoring systems scan regulatory databases and alert you to relevant changes immediately. They track your filing deadlines and flag potential compliance gaps before they become violations. Think of them as your automated compliance officer, working 24/7 to keep you clear of regulatory trouble.

Future-Proofing Your Real Estate Investment Strategy

The UAE property market of 2030 will look nothing like today's landscape. Digital assets, tokenisation and blockchain-based ownership structures are already emerging. Climate resilience requirements will reshape building standards. Real estate risk management strategies must evolve accordingly.

Success requires accepting that yesterday's playbook won't work tomorrow. The investors who thrive will be those who build adaptive systems rather than rigid rules. They'll measure risk dynamically, adjust strategies quarterly and maintain the flexibility to pivot when markets shift.

Your risk management framework should feel like a living system, not a static document. Review it monthly. Stress-test it quarterly. Question every assumption annually. Because in UAE real estate, the only constant is change - and the prepared investors are the ones who profit from it.

FAQs

What are the main regulatory risks affecting UAE property investors in 2025?

The primary regulatory risks include evolving foreign ownership laws, new sustainability compliance requirements, stricter AML reporting standards and potential changes to visa-linked property investment schemes. The Real Estate Regulatory Agency continues tightening oversight, particularly around off-plan sales and escrow account management.

How does enhanced due diligence protect against money laundering in real estate?

Enhanced due diligence creates multiple verification layers that make laundering nearly impossible. It involves checking funding sources through banking channels, verifying buyer identities through government databases, tracking beneficial ownership structures and maintaining detailed transaction records. This comprehensive approach flags suspicious patterns before they become legal problems.

What role does AI play in modern property risk assessment?

AI analyses vast datasets to identify risk patterns humans miss. It predicts maintenance issues through sensor data, forecasts market movements through social sentiment analysis and flags compliance risks through regulatory scanning. Machine learning models now achieve 85% accuracy in predicting property values 12 months forward.

Which UAE locations present the lowest investment risk profiles?

Established areas with complete infrastructure typically offer lower risk. Dubai Marina, Downtown Dubai and Abu Dhabi's Al Reem Island show consistent performance. However, 'lowest risk' doesn't mean 'best returns'. Sometimes calculated risks in emerging areas like Dubai South or Sharjah's Aljada deliver superior risk-adjusted returns.

How can investors assess cryptocurrency-related risks in property transactions?

Cryptocurrency transactions require extra vigilance around source verification, price volatility during transaction periods and regulatory compliance. Work with exchanges that provide clear audit trails. Use escrow services that handle crypto-to-fiat conversion. Most importantly ensure your transaction structure complies with both UAE cryptocurrency regulations and real estate laws.

)

)

)