Why to Invest in Dubai Real Estate: Key Advantages Explained

Dubai's property market reputation as a tax-free paradise draws millions in investment annually. But here's the kicker - most investors chase the wrong metrics entirely. They obsess over rental yields whilst missing the real goldmine: the strategic advantages that compound over decades, not quarters.

Why Dubai?

Strategic location

Picture this: you're sitting in Dubai at 9 AM, and you can conduct business with Tokyo as they wrap up their day, London as they start theirs, and catch New York before they sleep. That's not just convenient. It's powerful. Dubai sits at the crossroads of three continents, putting 3.5 billion people within a four-hour flight radius. This isn't about geography textbooks - it's about your tenants being executives who chose Dubai precisely because they can manage Asian suppliers and European clients from the same office.

Future of business

The emirate pumps AED 400 billion into infrastructure projects that read like science fiction. Think autonomous transport systems, AI-powered government services, and entire districts designed from scratch for the metaverse economy. Your property investment isn't just buying into today's market. You're betting on tomorrow's Silicon Valley.

Growth driver

Dubai's GDP grew 4.4% in 2023 whilst much of the world flirted with recession. But the real story? Non-oil sectors now drive 95% of the economy. Tourism, finance, logistics, and tech aren't supporting actors anymore - they're the main show. What does this mean for your investment? Simple: economic stability that doesn't swing with oil prices.

Cosmopolitan lifestyle

Here's something the spreadsheets miss: Dubai hosts 200 nationalities living side by side. Your property attracts tenants from Mumbai tech entrepreneurs to London bankers to Moscow venture capitalists. Each brings different rental expectations and payment capacities. That diversity? It's your hedge against any single market downturn.

Exceptional entertainment

Let's be honest - lifestyle sells property. Dubai delivers experiences you can't replicate elsewhere: skiing in a desert mall, dining underwater, or watching the world's tallest fountain show from your balcony. These aren't just tourist gimmicks. They're the reason executives accept relocations and families choose long-term residency.

Key business activities

GITEX, Arab Health, the Dubai Airshow - these aren't just events. They're annual migrations of global decision-makers who need accommodation, often deciding to establish permanent bases after experiencing the city. Your investment property becomes their corporate housing and eventually their permanent address. See the progression?

Top Investment Advantages of Dubai Real Estate

1. Zero Tax Environment on Property Investment

No capital gains tax. No property tax. No inheritance tax. Let that sink in for a moment. You buy a property for AED 2 million, sell it for AED 3 million five years later, and that million-dirham profit? All yours. Compare that to London, where you'd lose 28% to capital gains, or Singapore with its 17% stamp duty. The maths is brutal elsewhere.

But here's what most investors miss: the zero-tax advantage compounds. Every dirham you save on taxes gets reinvested into your next property. After three investment cycles, you're operating with 40-50% more capital than investors in taxed markets. That's the real reason to invest in Dubai real estate - not for one tax-free transaction, but for the multiplier effect across your portfolio.

2. Golden Visa Residency Through Real Estate

Forget the old visa runs every 30 days. Buy a property worth AED 2 million (roughly £430,000), and Dubai hands you a 10-year renewable residency. Not a vacation permit - proper residency with the right to sponsor family, establish businesses, and access healthcare.

|

Investment Amount |

Visa Duration |

Additional Benefits |

|

AED 750,000 |

2 years

|

Basic residency, renewable |

|

AED 2 million |

10 years |

Family sponsorship, business setup rights |

|

AED 10 million |

10 years |

Premium benefits, expedited processing |

The knock-on effects? Your kids attend world-class schools. You build local business networks. Your property becomes not just an investment but your gateway to the entire GCC market.

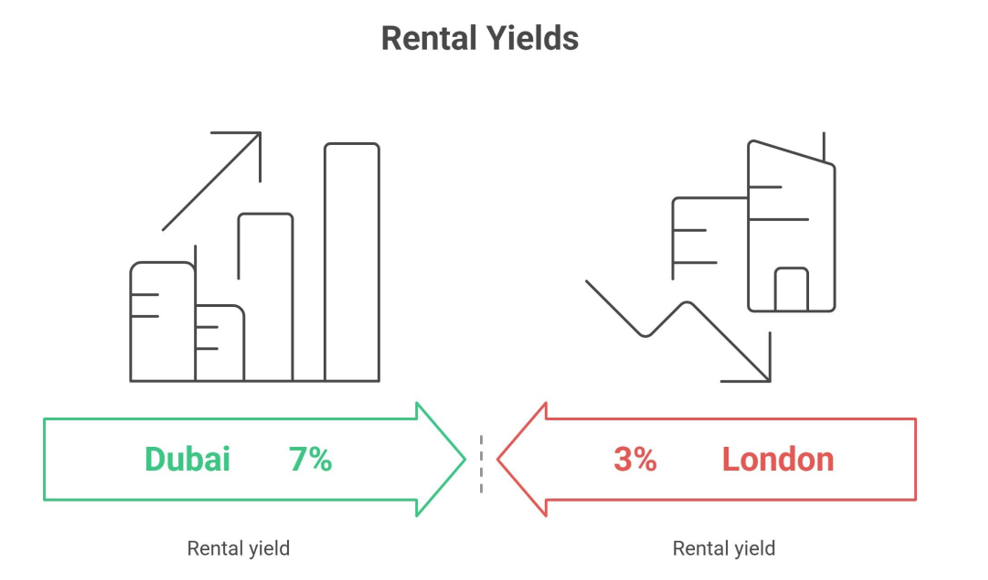

3. High Rental Yields and Capital Appreciation

Dubai delivers 5-9% rental yields when London struggles to break 3%. But don't get seduced by the percentages alone. A two-bedroom in Dubai Marina pulling 7% yield also appreciated 15% last year. You're playing both sides of the returns equation.

The sweet spot? Off-plan properties in emerging districts. Buy during launch at 20% below market, collect rental income from year two, and watch capital values climb as the area develops. JVC properties bought in 2020 now rent for 40% more than projected. That's not speculation - that's strategic positioning.

4. 100% Foreign Ownership in Designated Areas

No local partner needed. No trust structures. No complicated holding companies. You own the property outright, with your name on the title deed. Freehold areas like Downtown, Marina, and Palm Jumeirah offer complete foreign ownership. Your property, your rules, your profits.

This matters more than you think. In markets requiring local partnerships, disputes eat into returns, and exits become nightmares. Dubai's straightforward ownership means you can buy, sell, or transfer properties in days, not months. Liquidity matters when opportunities arise.

5. Currency Stability with USD-Pegged Dirham

The dirham has been pegged to the US dollar at 3.67 since 1997. Twenty-six years of stability whilst other emerging market currencies yo-yoed. When you calculate returns, what you see is what you get. No hidden forex losses eating your profits.

Smart investors leverage this stability. Borrow in dirhams at 4%, invest in properties yielding 7%, and pocket the spread without currency risk. Try that in Turkey or Egypt and watch exchange rates destroy your calculations overnight.

6. Strong Economic Growth and Market Stability

Dubai's property market learned from 2008. Today's regulations require 20% deposits, cap loan-to-value ratios, and restrict speculation. The result? Steady growth instead of bubbles. Prices climbed 17% in 2023, but with actual demand from end-users and investors, not speculators flipping contracts.

"The fundamental difference now is that 65% of buyers are end-users, not investors. That's real demand, not speculation." - Dubai Land Department Report, 2024

Prime Investment Locations and Property Types

Downtown Dubai and Business Bay

Everyone knows Burj Khalifa, but the real opportunity lies in Business Bay's transformation. Once a construction site, now a thriving business district where one-bedrooms yield 8% annually. The secret? Corporate tenants who pay premiums for walking distance to offices. A AED 1.5 million studio here outperforms an AED 2 million villa in the suburbs. Location still trumps size.

Dubai Marina and JBR

The Marina tells two stories. Waterfront apartments command 30% premiums and never stay vacant. But here's what agents won't tell you: inner Marina units, just 200 metres from the water, offer better yields because purchase prices are lower whilst rents stay competitive. Your AED 900,000 one-bedroom earns nearly the same as an AED 1.3 million waterfront unit. Do the maths.

Palm Jumeirah and Waterfront Properties

The Palm remains Dubai's trophy address, but forget the Fronds - too isolated. The Shoreline Apartments offer the sweet combination: Palm address, accessible location, and 6% yields. Villas here start at AED 8 million, but apartments from AED 2.5 million deliver similar prestige with better rental ratios.

Dubai Hills Estate and MBR City

Mohammed Bin Rashid City isn't just another mega-project. It's Dubai's answer to suburban living with urban amenities. Families pay premium rents for properties near schools and parks. A three-bedroom villa here rents for AED 250,000 annually - that's banker and consultant territory. The kicker? Off-plan prices still offer 15-20% discounts to ready properties.

Emerging Areas: Dubai Creek Harbour and Dubai South

Dubai Creek Harbour sits 10 minutes from Downtown but trades at a 40% discount. That gap will close. Dubai South surrounds the new Al Maktoum Airport, set to become the world's largest. Properties here aren't for today's rental market - they're for 2030 when 260 million passengers need accommodation. Patient capital wins here.

Affordable High-Yield Options: JVC and Dubai Silicon Oasis

JVC and DSO are Dubai's yield machines. Unglamorous? Yes. Profitable? Absolutely. Studios under AED 500,000 rent for AED 35,000-40,000. That's 8% yields with tenants queuing up. These areas house Dubai's workforce - the steady, reliable renters who pay on time and renew leases. Sometimes boring is beautiful.

Making Your Dubai Real Estate Investment Decision

Here's the truth about Dubai real estate investment opportunities: the best returns don't come from chasing headlines about the world's tallest this or biggest that. They come from understanding fundamental advantages and positioning accordingly.

Think about it. Where else can you buy property with no taxes, gain long-term residency, earn 7% yields, and watch values appreciate 10-15% annually? Singapore taxes you to death. London's yields barely cover inflation. Hong Kong requires millions just to enter.

Dubai isn't perfect. Service charges can surprise you (budget 15-20 AED per square foot annually). The summer heat drives tenants away from May to September. And yes, oversupply risks exist in certain segments.

But for investors seeking a combination of yield, growth, and lifestyle benefits, Dubai delivers something unique. Not just an investment, but an option on the future. The question isn't really whether to invest anymore. It's whether you'll move fast enough to capture the opportunities before institutional investors price you out.

Ready to take the next step? Start with these actions:

- Set your budget floor at AED 750,000 for visa eligibility

- Focus on established areas with metro access for reliable yields

- Consider off-plan in emerging districts for capital appreciation

- Factor in 7% purchase costs and 5% annual service charges

- Work with DLD-registered agents only - non-negotiable

The Dubai property market won't wait for you to overcome analysis paralysis. Every month you delay, prices climb another per cent. That's not pressure - that's mathematics.

FAQs

What is the minimum investment for Dubai's Golden Visa?

AED 2 million (approximately £430,000) gets you a 10-year renewable Golden Visa. But here's the insider move: you can combine multiple properties to reach this threshold. Buy three AED 700,000 studios across different developments, diversify your risk, and still qualify. Most investors don't know this loophole exists.

Can foreigners get mortgages for Dubai properties?

Yes, but expect different terms than locals. Foreign buyers access 50-80% financing depending on residency status. First-time buyers get up to 80% LTV for properties under AED 5 million. The catch? Interest rates run 4-6%, and you'll need six months of Dubai bank statements. Pro tip: Islamic mortgages sometimes offer better terms than conventional loans.

Which areas offer the highest rental yields in Dubai?

JVC, Dubai Sports City, and International City deliver 8-10% gross yields. But net yields tell the real story. After service charges and maintenance, JVC's 8% gross becomes 6.5% net, whilst Downtown's 5% gross translates to 3.5% net. Choose your metric carefully. Chasing headline yields in remote areas often means accepting higher vacancy rates.

Is off-plan property investment profitable in Dubai?

Off-plan offers 20-30% discounts and flexible payment plans, but timing is everything. Properties from established developers (Emaar, Damac, Sobha) in proven locations typically appreciate 15-25% by handover. The risk? Delays and market shifts. Never invest more than 40% of your portfolio in off-plan, and always verify developer track records through DLD.

What are the transaction costs when buying property in Dubai?

Budget 7-8% above purchase price. That breaks down to: 4% DLD transfer fee, 2% agent commission, AED 4,000 title deed issuance, mortgage registration fees if applicable, and various admin charges totalling AED 5,000-10,000. Cash buyers save on mortgage fees but still face 7% all-in costs. Factor these into your yield calculations from day one.

)

)

)